Mortgage debt is impacting the confidence of many retirees

Vanguard’s How Australia Retires 2025 report reveals a concerning trend: more Australians are expecting to enter retirement with mortgage debt, and it’s having a real impact on how they feel about their financial future.

The findings are based on a nationally representative survey of 1,800 Australians aged 18 and over conducted in February 2025.

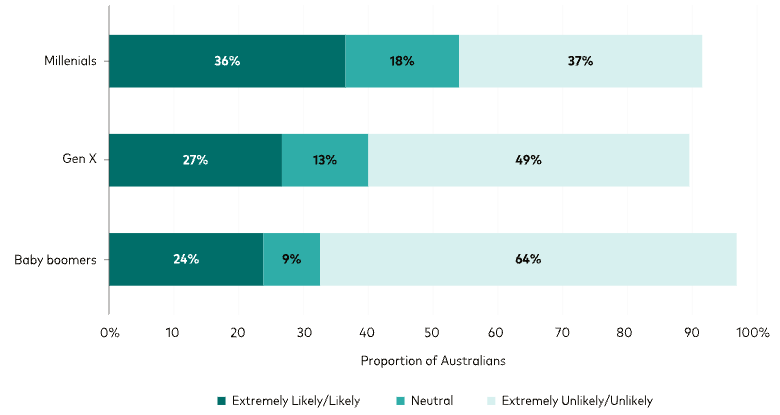

More than one in three Millennials (36%) expect to have a mortgage when they retire, compared to 27% of Gen X and 24% of Baby Boomers. In contrast, the report found that only 8% of those who had already retired were still paying a mortgage this year.

Figure 1: Self-assessed likelihood of having a mortgage at retirement by generation

Source: Vanguard How Australia Retires 2025 report

It also represents a significant shift from 1999, when 91% of older Australians living in couple-only households were homeowners and 88% of them owned their homes outright.1

Few Australian retirees are planning to move to smaller or more affordable homes.

The impact of having a mortgage in retirement

Unsurprisingly, Australians who retire with a mortgage tend to have lower confidence and feel less positive about retirement.

Nearly half (48%) of Australians who retired with a mortgage said they were “slightly” or “not at all” confident about retirement, compared to only 28% of all retirees.

Meanwhile, the proportion of retirees with positive sentiment dropped from 65% overall to 48% among those still paying off a mortgage.2

In other words, it’s a burden that weighs on both your finances and your peace of mind.

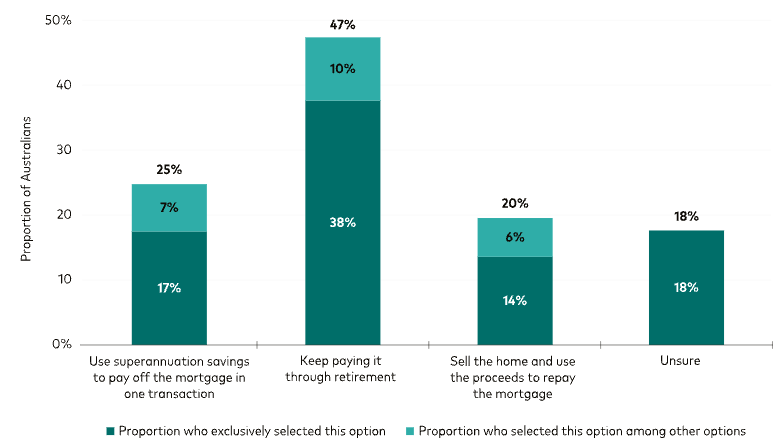

When working-age Australians were asked how they will manage their mortgages during retirement, nearly half (47%) said they expect to continue making payments during retirement.

Meanwhile, one in four (25%) said they plan to pay off their mortgage in a single transaction using their superannuation.

Figure 2: How Australians would manage a mortgage during retirement

Source: Vanguard How Australia Retires 2025 report

The impact of renting in retirement

Renting adds another layer of complexity. About one in five retirees are renters, and only 10% of them feel highly confident about their retirement compared to 35% of retirees overall.

That’s largely because renters tend to have lower wealth and income and face more uncertainty around housing later in life.

Without the stability and control that comes with home ownership, it’s harder to feel secure about the future.

Why many retirees are unlikely to downsize

A common assumption is that older Australians can sell their family homes and downsize as they transition into retirement.

This can help retirees unlock a significant portion of their wealth to either fund their retirement lifestyle, pay off remaining mortgage debt or reduce the burden of maintaining a larger property.

However, our research finds that few Australian retirees are planning to move to smaller or more affordable homes.

This year’s survey found that less than 30% of retired Australians have moved or are planning to move into a new home since retiring.

In fact, most retirees see their home as something to hold onto either for life or to pass on as an inheritance. Only 9% of those surveyed considered their home a potential source of retirement funding.

What these findings mean

Home ownership plays a vital role in Australia’s retirement system, so much so that some argue it should be recognised as the “fourth pillar” after superannuation, the Age Pension and private savings.

While two-thirds of today’s retirees own their homes outright, it’s clear that younger Australians could face a very different housing reality in retirement.

The findings suggest a need for expanded pathways to home ownership for young Australians or, alternatively, to support them in achieving financial security through other means.

To learn more about the research, including the five building blocks for a more confident retirement, head to the How Australia Retires website.

Notes:

1. Australian Bureau of Statistics (2001), Australian Social Trends 2001, Housing and Lifestyle: Housing experience through life-cycle stages, ABS Website.

2. To assess Australians’ sentiment toward retirement, respondents selected from ten emotion-related words (five positive, five negative), plus “unsure” or “none of these.” Sentiment was classified as positive if only positive words were chosen.

Source: October 2025

This article has been reprinted with the permission of Vanguard Investments Australia Ltd. Copyright Smart Investing

GENERAL ADVICE WARNING

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) (VIA) is the product issuer and operator of Vanguard Personal Investor. Vanguard Super Pty Ltd (ABN 73 643 614 386 / AFS Licence 526270) (the Trustee) is the trustee and product issuer of Vanguard Super (ABN 27 923 449 966).

The Trustee has contracted with VIA to provide some services for Vanguard Super. Any general advice is provided by VIA. The Trustee and VIA are both wholly owned subsidiaries of The Vanguard Group, Inc (collectively, “Vanguard”).

We have not taken your or your clients’ objectives, financial situation or needs into account when preparing our website content so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation or needs, and the disclosure documents for the product before making any investment decision. Before you make any financial decision regarding the product, you should seek professional advice from a suitably qualified adviser. A copy of the Target Market Determinations (TMD) for Vanguard’s financial products can be obtained on our website free of charge, which includes a description of who the financial product is appropriate for. You should refer to the TMD of the product before making any investment decisions. You can access our Investor Directed Portfolio Service (IDPS) Guide, Product Disclosure Statements (PDS), Prospectus and TMD at vanguard.com.au and Vanguard Super SaveSmart and TMD at vanguard.com.au/super or by calling 1300 655 101. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. This website was prepared in good faith and we accept no liability for any errors or omissions.

Important Legal Notice – Offer not to persons outside Australia

The PDS, IDPS Guide or Prospectus does not constitute an offer or invitation in any jurisdiction other than in Australia. Applications from outside Australia will not be accepted. For the avoidance of doubt, these products are not intended to be sold to US Persons as defined under Regulation S of the US federal securities laws.

© 2025 Vanguard Investments Australia Ltd. All rights reserved.