Bull market surges have been longer and stronger than the bear markets that preceded them.

Bear markets occur when a share market falls by 20 per cent or more from its most recent trading high.

Volatile economic and investment conditions caused the United States share market to fall into bear market territory in 2022. Fortunately, for most Australian investors, our broad share market managed to stay of the bear woods even though it did record an overall annual loss.

Since the start of this year the US share market has regained much of the ground it lost in 2022.

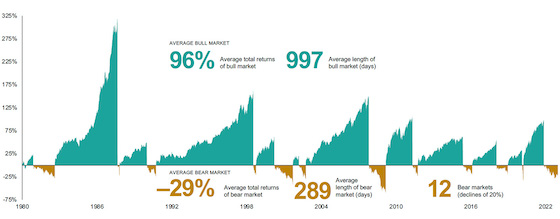

And the chart below gives a good perspective on the length of bear markets over time versus bull markets – the term used to describe when markets are rising over a prolonged period.

Bear market facts

While bear markets can be daunting, on average they have lasted much shorter than bull markets and have had far less of an effect on long-term performance.

Bear markets are challenging, but bull markets have been longer and stronger

Note: Although the downturns that began in August 1987 (related to Black Monday) and February 2020 (related to the start of the COVID-19 pandemic) don’t meet a widely accepted definition of a bear market because they lasted less than two months, we are counting them as bear markets and including them in our analysis because of their historic nature.

Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Sources: Vanguard calculations, as of December 31, 2022, using the MSCI World Index from January 1, 1980, through December 3, 1987, and the MSCI ACWI thereafter. Indexed to 100 as of December 31, 1979.

From January 1, 1980, through December 31, 2022, the average length of a bull market has been nearly four times that of a bear market.

Similarly, the depth of losses from a bear market has paled in comparison with the magnitude of bull-market gains.

That’s one reason for sticking to a well-thought-out investment plan: Losses from a bear market have typically given way to longer and stronger gains.

It’s worth noting that although the downturns that began in August 1987 (related to Black Monday) and February 2020 (related to the start of the COVID-19 pandemic) don’t meet a widely accepted definition of a bear market because they lasted less than two months, we are counting them as bear markets and including them in our analysis because of their historic nature and the magnitudes of their declines.

Important information and general advice warning

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer and the Operator of Vanguard Personal Investor and the issuer of the Vanguard® Australian ETFs. We have not taken your objectives, financial situation or needs into account when preparing the above article so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation or needs, and the disclosure documents for any relevant Vanguard product, before making any investment decision. Before you make any financial decision regarding Vanguard investment products, you should seek professional advice from a suitably qualified adviser. A copy of the Target Market Determinations (TMD) for Vanguard’s financial products can be obtained at vanguard.com.au free of charge and include a description of who the financial product is appropriate for. You should refer to the relevant TMD before making any investment decisions. You can access our IDPS Guide, PDSs Prospectus and TMD at vanguard.com.au or by calling 1300 655 101. Vanguard ETFs will only be issued to Authorised Participants. That is, persons who have entered into an Authorised Participant Agreement with Vanguard (“Eligible Investors”). Retail investors can transact in Vanguard ETFs through Vanguard Personal Investor, a stockbroker or financial adviser on the secondary market. Retail investors can only use the Prospectus or PDS for informational purposes. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. This article was prepared in good faith and we accept no liability for any errors or omissions.

© 2023 Vanguard Investments Australia Ltd. All rights reserved.