Maintaining diversification, managing risk, and enhancing long-term returns

Multi-asset portfolios are designed to provide diversification by spreading investments across various asset classes to reduce risk.

Over time, however, some asset classes may become overweighted (or underweighted), potentially reducing a portfolio’s overall diversification.

For example, if equities perform exceptionally well, a portfolio that was initially well-diversified could become heavily concentrated in stocks, increasing the portfolio’s exposure to the volatility of the stock market.

Rebalancing helps restore the intended diversification. It enables investors to rebalance their portfolio across different asset classes, thus ensuring they are not overly exposed to any single asset class.

A diversified portfolio is typically less volatile than one that is concentrated in just a few assets or sectors, which is crucial for long-term growth and risk reduction.

Moreover, maintaining a diversified portfolio helps investors capture returns from different sources. For instance, bonds may perform well during periods of economic uncertainty, while stocks might thrive in a growing economy.

By keeping allocations balanced across asset classes, investors are better positioned to benefit from shifts in the economic landscape.

The benefits of rebalancing range from risk management to enhancing portfolio performance and make it a critical component of a successful investment strategy.

Below we outline the key advantages of rebalancing a multi-asset portfolio and why it should be part of every investor’s toolkit.

1. Maintaining desired risk profile

A core goal of rebalancing is maintaining a portfolio that aligns with your risk tolerance.

Asset classes such as equities and bonds behave differently in varying economic conditions. Over time, some assets may outperform while others underperform, leading to a drift in the portfolio’s overall risk profile.

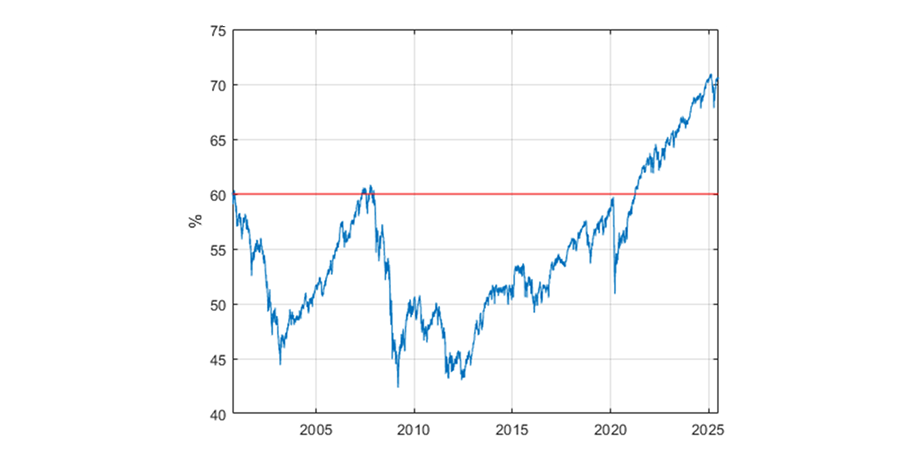

For example, in a portfolio that aims for a 60/40 split between stocks and bonds, a significant bull market could cause stocks to outperform, pushing the allocation to 70% stocks and 30% bonds. This is illustrated in Figure 1, where we find that over the last 25 years, a 60/40 portfolio which is not rebalanced would have seen its equity allocation drift between 40% to 70%.

Figure 1. Equity allocation drift in a 60/40 portfolio with no rebalancing

Source: Vanguard. Notes: Returns are from 1/10/2000 to 30/6/2025 for a portfolio with a 60% allocation to equities and 40% to fixed income. A home bias of 40% is applied to both equities and fixed income. The benchmarks used were: S&P.ASX Total Return 300 for Australian equities, MSCI World ex Aus Net Total Return AUD Index for global equities, Bloomberg AusBond Composite 0+ Year Index for Australian fixed income and Bloomberg Global Aggregate Total Return Index Value Hedged AUD for global fixed income.

This could increase the portfolio’s overall risk exposure, as stocks are typically more volatile than bonds. Rebalancing ensures that the portfolio returns to its original risk level, reducing the chance of an unwanted exposure to excessive risk.

By periodically adjusting asset weights, investors ensure their portfolio remains consistent with their risk tolerance, whether it’s conservative, moderate, or aggressive. This can be particularly crucial in times of market volatility, as it helps protect the investor from unnecessary downturns.

2. Locking in Gains – Selling High/Buying Low

An innate feature of rebalancing is its ability to lock in gains by selling over performing assets and buying into underperforming assets at lower price.

For example, if the market experiences a downturn and bonds outperform stocks, an investor who rebalances will be buying more stocks while they are cheaper, setting up the portfolio for better returns in the future when the equity markets recover. Conversely, during a bull market, rebalancing will help the investor lock in profits from equities and buy more bonds, balancing the risk for the next phase of the market cycle.

Rebalancing thus supports the buy low, sell high investment principle. By systematically selling appreciated assets and buying those that have not performed as well, investors are often able to purchase assets at relatively lower prices, improving the long-term potential of their portfolio.

3. Enhancing Long-Term Returns

Rebalancing contributes to long-term performance by adhering to the investment strategy set at the outset. Over time, the market cycle will cause different asset classes to perform at varying rates, but a disciplined rebalancing approach ensures that the portfolio stays aligned with the investor’s strategic goals.

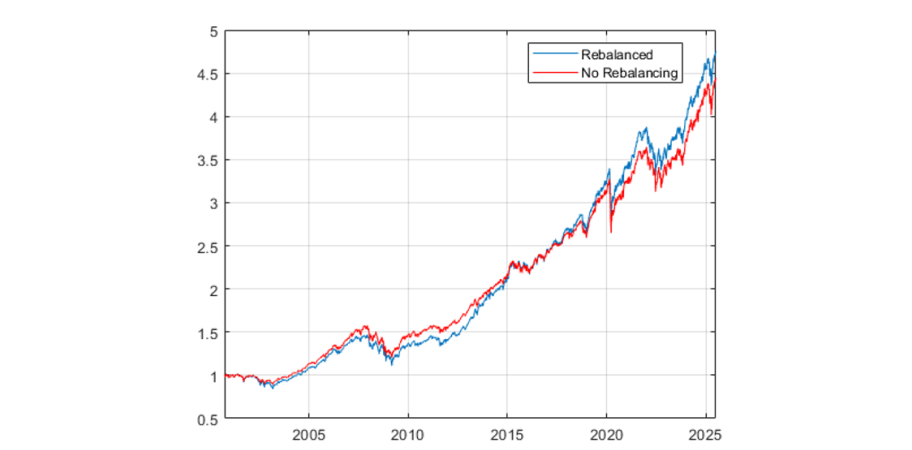

Over the long term, rebalancing at regular intervals (e.g., daily, quarterly or annually) allows investors to consistently benefit from the buy low/sell high feature, and this will generally lead to better risk adjusted returns. Figure 2 shows that the total wealth accumulation for a 60/40 portfolio is higher for the rebalanced portfolio (368%) versus a portfolio that is not rebalanced (337%), and this is achieved with a better risk adjusted return with a daily rebalanced portfolio achieving a Return/Volume ratio of 0.90 versus 0.85 for a portfolio with no rebalancing (see Table 1).

Figure 2. Wealth accumulation for a 60/40 portfolio with and without rebalancing

Source: Vanguard. Notes: Returns are from 1/10/2000 to 30/6/2025 for a portfolio with a 60% allocation to equities and 40% to fixed income. A home bias of 40% is applied to both equities and fixed income. The benchmarks used were: S&P.ASX Total Return 300 for Australian equities, MSCI World ex Aus Net Total Return AUD Index for global equities, Bloomberg AusBond Composite 0+ Year Index for Australian fixed income and Bloomberg Global Aggregate Total Return Index Value Hedged AUD for global fixed income.

Table 1: Long term performance of a 60/40 portfolio

| Total Return (%) | Annualised Return (%) | Volatility (%) | Return/Vol | |

|---|---|---|---|---|

| Rebalanced | 376.18 | 6.51 | 7.00 | 0.91 |

| No rebalancing | 344.75 | 6.22 | 6.45 | 0.86 |

Source: Vanguard

4. Investment Discipline and Strategy Adherence

Investing is often fraught with emotional decision-making, especially during periods of market volatility. Many investors succumb to the temptation to chase hot trends or panic during a market downturn, which can lead to suboptimal decisions.

Rebalancing offers an element of discipline to the investment process. It forces investors to adhere to their original asset allocation plan, preventing rash decisions based on fear or greed. In essence, rebalancing provides a structured approach to maintaining a long-term perspective, enabling investors to focus on their goals rather than reacting impulsively to short-term market fluctuations.

Make no mistake, keeping investment portfolios aligned to specific asset weightings is a difficult and ongoing exercise. It’s actually a balancing act, because there are usually trading costs involved in buying and selling assets as well as potential capital gains tax consequences.

At the same time, market fluctuations may result in a rebalanced portfolio underperforming over the shorter term if the stronger-performing assets that have been sold continue to rally.

By contrast, there’s a key difference between how a portfolio manager can readily rebalance a diversified portfolio versus the average retail investor.

That is, rather than having to sell assets to keep a portfolio aligned, portfolio managers use cash inflows to buy underweight assets whenever they can to keep a portfolio within its target asset tolerance levels. This minimises turnover and reduces the need to realise capital gains in the fund.

Conclusion

Rebalancing is an essential part of managing a multi-asset portfolio effectively. By maintaining the desired risk profile, locking in gains, enhancing diversification, improving long-term returns, and promoting investment discipline, rebalancing can significantly improve the success of an investment strategy.

While the markets will always fluctuate, rebalancing allows investors to navigate these fluctuations with confidence and structure. It ensures that an investment portfolio remains on track, is aligned with the investor’s objectives, and is adaptable to shifting market conditions.

Source: This article has been reprinted with the permission of Vanguard Investments Australia Ltd. Copyright Smart Investing

GENERAL ADVICE WARNING

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) (VIA) is the product issuer and operator of Vanguard Personal Investor. Vanguard Super Pty Ltd (ABN 73 643 614 386 / AFS Licence 526270) (the Trustee) is the trustee and product issuer of Vanguard Super (ABN 27 923 449 966).

The Trustee has contracted with VIA to provide some services for Vanguard Super. Any general advice is provided by VIA. The Trustee and VIA are both wholly owned subsidiaries of The Vanguard Group, Inc (collectively, “Vanguard”).

We have not taken your or your clients’ objectives, financial situation or needs into account when preparing our website content so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation or needs, and the disclosure documents for the product before making any investment decision. Before you make any financial decision regarding the product, you should seek professional advice from a suitably qualified adviser. A copy of the Target Market Determinations (TMD) for Vanguard’s financial products can be obtained on our website free of charge, which includes a description of who the financial product is appropriate for. You should refer to the TMD of the product before making any investment decisions. You can access our Investor Directed Portfolio Service (IDPS) Guide, Product Disclosure Statements (PDS), Prospectus and TMD at vanguard.com.au and Vanguard Super SaveSmart and TMD at vanguard.com.au/super or by calling 1300 655 101. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. This website was prepared in good faith and we accept no liability for any errors or omissions.

Important Legal Notice – Offer not to persons outside Australia

The PDS, IDPS Guide or Prospectus does not constitute an offer or invitation in any jurisdiction other than in Australia. Applications from outside Australia will not be accepted. For the avoidance of doubt, these products are not intended to be sold to US Persons as defined under Regulation S of the US federal securities laws.

© 2025 Vanguard Investments Australia Ltd. All rights reserved.